Table of Contents

You may also interested:

So, you’re thinking of making money through investing in NFTs? The business world is divided between whether you should invest in NFTs or not. Some say that NFTs are just a flash in the pan. Yet there is evidence to show that some have made lots of money investing in NFTs. The direction is unclear. And rightfully so. The NFT space is still in its stage of infancy. Everyday, there’s something new going on. Meta and Polygon are collaborating on an NFT platform for Instagram. The creator of OnlyFans is planning to open up his own NFT platform. We don’t know yet how either will turn out. NFT tools and web apps shut down frequently. New NFT tools and websites appear in their place.

So where does that leave you? Should you or should you not invest in NFTs? In this article, we are going to dive into some conditions that you should be aware of if you’re thinking of investing in NFTs. In order to do this, we will break down these conditions into the “Must have”, “Could have”, “Should have” and “Won’t have”. This categorisation is known as the MosCow Method, and it is a popular tool used in user experience research.

Must have

1. Website

When shopping around for NFTs, don’t just buy off the secondary market on OpenSea, Rarible or Solana. You need to do research on the collection too. The first thing that is a must have is a website. And not just that, the website must have the following items too:

A self-doxx. What this means is that the creators of the NFT collection must declare who they are. They need to convince you that they are real, legit people.

A roadmap or whitepaper. Read the roadmap or whitepaper. Do you like their vision and mission? Do you like their social activities? Only invest in an NFT that you believe in. You might have heard about NFTs that have no roadmap or whitepaper such as Goblin Town. They succeeded without a roadmap but it was primarily because they allowed early mints at no cost. This is a novel strategy for marketing, but risky for the investor.

2. NFT Community

A community. Communities for NFTs are built on Discord, primarily. That is where most of the information about the NFT is shared. That is also where most of the buyers of the NFT collection congregate and integrate. Without a community, an NFT collection is doomed to fail. This is because NFTs are not yet a mainstream digital good. NFT creators cannot go through the normal digital marketing channels to convert sales. As such, the sales come primarily from the community they built.

3. High owner:item ratio

A high “owner”:”item” ratio. You can get this information from the marketplace where the collection is listed such as OpenSea. See below for a case study. A high “owner”:”item” ratio means that the NFTs have changed hands a fair bit. With every resale, there is a chance that the NFT has been sold at a higher price. That’s good news for the investor.

4. High volume traded:date of first mint ratio

A high “volume traded”:”date of first mint” ratio. You can get this information from the marketplaces too. See below for a case study. A high “volume traded”:”date of first mint” ratio means that the NFT collection has been gaining traction and sales have been good. This prompts further awareness and sales. That’s good news for the investor.

Could have

1. CC0

CC0 means creative commons “no licence”. Anyone can use the NFT for any purpose whatsoever. While some commentators have seen this to be a novel move towards more openness, others see it as a commercial liability. Nonetheless, there is a trend where buyers are looking out for CC0 NFTs. You could go with this flow, but it’s still just a trend at the moment.

2. Utility

Utility. Web3 is talking all about the utility of NFTs these days. Many commentators are saying that the NFT space are moving away from mere JPEGs and GIFs to NFTs which have a use. Some are even talking about phygital use, where NFTs package physical items together with artwork. Again, all this is cool, but utility items are only packaged upon early mints and first public mints. Resold NFTs may or may not contain those same utility items. Smart contracts do not ensure that the new owner also obtain the utility items. Until this gap is plugged, NFTs with utility are going to be only worthy of a first sale. It’s not going to change hands very much, or at all. Not good for investment.

Should have

1. Number of unique holders

What you want to look out for are the same names and wallet addresses trading NFTs with each other over and over again. This may mean that there’s a small bunch of people trying to inflate the price of the NFTs by buying and selling to each other back and forth. That’s a big red flag for investment.

2. On-chain metadata

Creators have a choice as to whether they store their NFT media on the blockchain (on-chain) or on another server (off-chain). Storing on-chain means that the data cannot be changed but it also is a storage strain on the chain. Storing off-chain means that the data does not pose a storage strain on the chain, but it does leave the buyer vulnerable. The NFT can be deleted or transferred. As an investor, we should opt to buy on-chain NFTs where possible.

Won’t have

If it’s too good to be true, it probably is. If any NFT creator offers you free or cheap NFTs out of the blue, it’s probably not going to be a good investment. I mean, sure, you can accept the NFT or buy for the fun of it but beware that it might be a scam. NFT creators don’t just pick people randomly to give free NFTs or sell them cheaply to you. They would have asked you for your wallet address and gotten you to participate in their community building efforts for them to select you for whitelisting or early minting.

NFT Investment Case Study

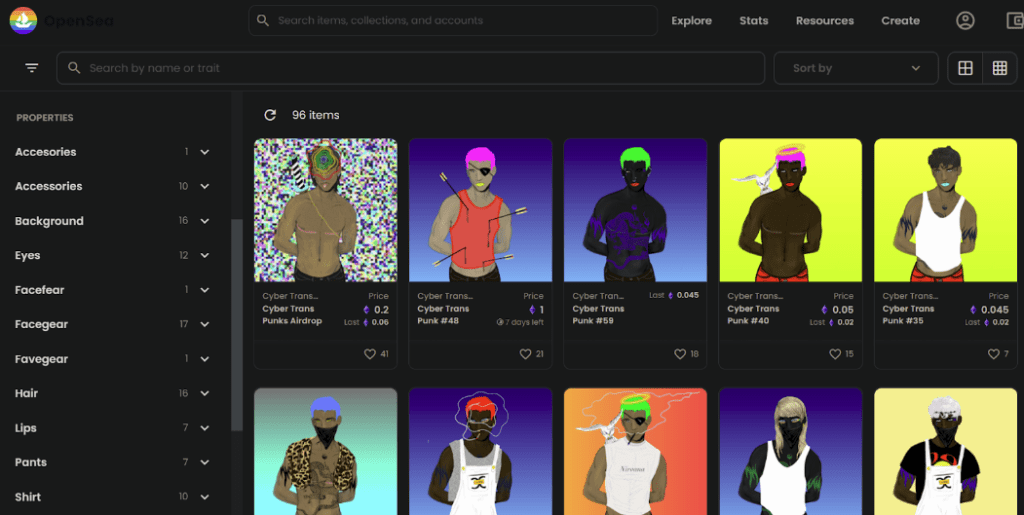

Take a look at the following case study of Cyber Trans Punk created by BobbytheCoyote listed on OpenSea.

Right off the bat, we can see some indicators of investment opportunity.

- Items: Does it matter how many items are listed? No. You might be inclined to intuitively think that a smaller number of items means that each item will be rarer than collections with a larger number of items, right? That is only part of the picture. First of all, the number of items is only the number of items that have been listed at the moment. The creator may have a pipeline to create more items. You never know unless you’re following the creator on his digital platforms (such as Discord, Telegram or Instagram).

- Owners: The raw number of owners does not matter but the ratio of the number of owners to the number of items does matter a lot. A higher ratio of owners:items signals a possible investment opportunity because it means that the NFTs have changed hands a fair bit in the secondary resale market.

- Floor price: Floor price simply means the price of the cheapest item in the collection. It’s not a great indicator of investment opportunity, although one might see it as a bullish movement.

- Total volume traded: This refers to how much money has exchanged hands over the items in the collection. It does not show you how much money the creator himself has made. The raw total volume itself does not indicate much. You need to compare the volume traded with the date of public minting. If the volume traded seems a bit low for a collection that was minted some time ago, avoid it. It means that there is no traction in the market. So how do you see the date of public minting? Go over to the Activity tab.

It shows that the public minting began in March 20, 2022. From then, until 7 June 2022, the volume traded has only been 4.4 ETH. The graph shows why. It had a really show start and picked up only in June 2022. The movement in the past 7 days has also been unstable, so I recommend waiting a while more before committing to a purchase. What you want to do next is to look for the section on “Properties”. This will give you an indication of the rarity in design.

It shows that the public minting began in March 20, 2022. From then, until 7 June 2022, the volume traded has only been 4.4 ETH. The graph shows why. It had a really show start and picked up only in June 2022. The movement in the past 7 days has also been unstable, so I recommend waiting a while more before committing to a purchase. What you want to do next is to look for the section on “Properties”. This will give you an indication of the rarity in design.

There will be buyers who are going to prioritise the design in their purchases and thus will look for the rarest design. A high number in the properties list means that many designs will have that property. A low number means that not many will carry that. Those designs will consequently be the rarer designs. Looking through the entire catalog of this collection, we can see that there are several rare designs. Only one design holds each of the properties below:

Next, you will also want to go to the Activity tab to see the holders of the NFTs in the collection. From the Cyber Trans Punk transactions, we can see that the trades are between unique and discreet individuals.

Now, let’s choose one design that we like. We need to see where the metadata is stored. Click on the picture to go to its own page, then click on details.

We see that the metadata is “centralized”. That means that the NFT itself is stored on the Ethereum blockchain and the smart contract is “immutable” (it cannot be changed or hacked into).

Conclusion

There is a lot to consider before investing in an NFT. For example, you should research which platforms are the most reputable and have the most success stories. Additionally, you should always be aware of the risks involved in any investment and consult with a financial advisor if you have any questions. Finally, don’t forget to have fun with your new investment and explore all the different possibilities an NFT can offer!